Budgeting tips and tricks

You can afford this! Congratulations on taking the step to invest in your dream and yourself. Paying your way to graduation isn’t as difficult as you may think. Here are some helpful resources to help you prepare financially.

Attend our Thrifty Thursdays

Financial Aid and Awards presents Thrifty Thursdays, a series of workshops to help you stay on track financially.

We have even MORE rewards to help you learn AND save!

Workshop Draws

For anyone who attends the full workshop and fills out the feedback form within 1 hour of the workshop, will be entered in a draw for a $100 PC grocery gift card.* Draws will be 2 hours after the workshop and successful recipients will be notified by email!

*Read official contest rules and regulations

Semesterly Rewards

Attend four workshops in a semester to:

- be entered for a chance to win $250 on your ONEcard each semester**,

- receive a Financial Literacy badge to display on LinkedIn, and

- receive a Financial Literacy co-curricular record.

Upcoming workshops

Fall 2025

Co-presented by: Canadian Foundation for Economic Education (CFEE)

Thursday, Sept. 4 from 12:30 to 1:30 p.m.

Thursday, Sept. 18 from 12:30 to 1:30 p.m.

Guest speaker: Jonny Somers-Harris, BA, Comm, Prime Time Financial Inc.

Thursday, Oct. 2 from 12:30 to 1:30 p.m.

Guest speaker: Jonny Somers-Harris, BA, Comm, Prime Time Financial Inc.

Thursday, Oct. 16 from 12:30 to 1:30 p.m.

Guest speaker: Ryan Burwell, Henry Bernick Entrepreneurship Centre (HBEC)

Thursday, Oct. 30 from 12:30 to 1:30 p.m.

Co-presented by: Canadian Foundation for Economic Education (CFEE)

Thursday, Nov. 13 from 12:30 to 1:30 p.m.

Ready, Set File: International Taxes

Guest speaker: Maria Mejia, Your Financial Success Matrix

Thursday, Nov. 27 from 12:30 to 1:30 p.m.

Winter 2026

Co-presented by: Canadian Foundation for Economic Education (CFEE)

Thursday, Jan. 8 from 12:30 to 1:30 p.m.

Living a Financially Healthy Life

Co-presented by: Canadian Foundation for Economic Education (CFEE)

Thursday, Jan. 15 from 12:30 to 1:30 p.m.

Guest speaker: Mike Woods, CLU, CH.F.C, CHS, BeaconPoint FS Ltd.

Thursday, Jan. 29 from 12:30 to 1:30 p.m.

Presented by: Robert Kilner, CIRP, LIT, Spergel Corporate

Thursday, Feb. 12 from 12:30 to 1:30 p.m.

Presentation provided by: National Student Loans Service Centre (NSLSC)

Thursday, Feb. 26 from 12:30 to 1:30 p.m.

*Funding Your First Year

Thursday, Mar. 19 from 12:30 to 1:30 p.m. or

Thursday, May 7 from 6 to 7 p.m.

Guest speaker: Jonny Somers-Harris, BA, Comm, Prime Time Financial Inc.

Thursday, Mar. 26 from 12:30 to 1:30 p.m.

Filing Frenzy: Navigating Tax Time

Guest speaker: Maria Mejia, Your Financial Success Matrix

Thursday, Apr. 2 from 12:30 to 1:30 p.m.

*Both Funding Your First Year workshops will not be eligible for the semesterly rewards and attendance is not counted*

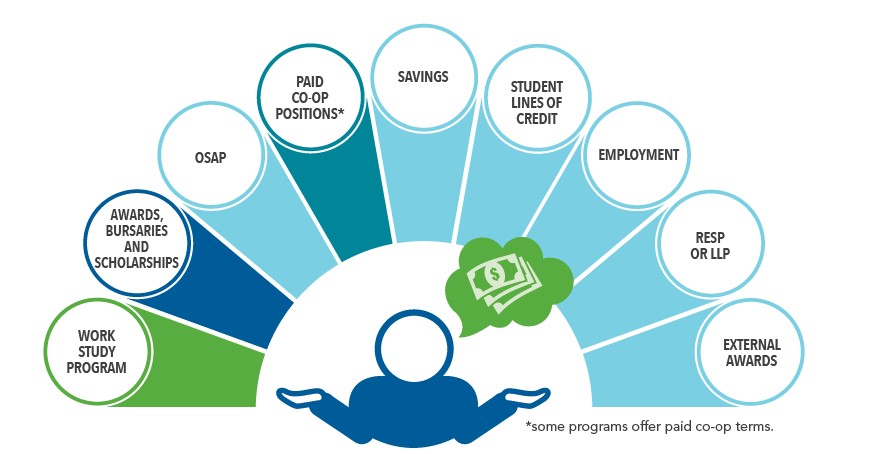

Figure out your sources of funding

We know many students find it tough to make ends meet, which is why we offer so many services and supports to help you pay from start to finish including:

- Entrance awards during the admission stage

- Ontario Student Assistance Program (OSAP)

- In-course awards during your studies

- Work Study Program (on-campus jobs)

There are other sources of funding for you to explore including:

- Savings: Plan to save for school including possible contributions from family.

- Student Lines of Credit: These are lines of credit offered by financial institutions specifically designed for students.

- Employment: Plan to work while studying or during any break terms.

- RESP: The Registered Education Savings Plan (RESP) is a tax-sheltered education savings account.

- LLP: The Lifelong Learning Program allows you to use money from your RRSPs without tax implications.

- External awards: Many companies and organizations offer awards to college-bound students.

Know your costs

It is important to know what your costs are, so that you can plan and budget to pay for them. Whether you’re living at home or away from home, can have a huge impact on your budget. Typical costs would include:

- Tuition and ancillary fees: Plan ahead and be sure to check your specific program costs. Also, know the fee deadlines.

- Books and supplies: Check with your program about anticipated costs for your program. Don’t underestimate the tools you will need to buy.

- Transportation: Your student card is a your bus pass. For those in placements or co-op, consider that you may need to allocate more travel costs. There may not be any guarantee that your placement is in the same city as your program. If you drive, you will need to figure out your car payments, insurance, gas, maintenance, and parking expenses.

- Residence or housing: Unless you are living at your family’s home for no expense, housing will be a considerable cost. Be sure to check with our housing resources for assistance. Be sure to include insurance (even for a rental).

- Food: Be sure to be realistic about your food budget, meal plan and shop around to save.

- Other expenses could include:

- Utilities (natural gas, electricity, water)

- Phone, cable, internet

- Child care costs

Plan your budget

Need help with budgeting? Check out our “My Budget” tool on MyGCLife.ca – manage your money

more effectively, save for expenses and prepare for emergencies.

The budget template includes educational expenses, housing, food, transportation, miscellaneous costs and health insurance, as well as sources of income from scholarships, grants, bursaries, RESP, loans, OSAP and work. The template is intuitive and easy to understand.

Contact us

Financial Aid and Awards provides a centralized service located at the Barrie Campus within the Office of the Registrar.

Please note, all Financial Aid and Awards services are available both in person and remotely.

Phone: 705.722.1530

Fax: 705.722.5136

Email: financialaid@georgiancollege.ca

In-person office hours: Monday to Friday, 8:30 a.m. to 4 p.m.

Phone/email hours: Monday to Friday, 8:30 a.m. to 4:30 p.m.